Algorithms powering John Ruiz’s company being probed by SEC, Justice Department

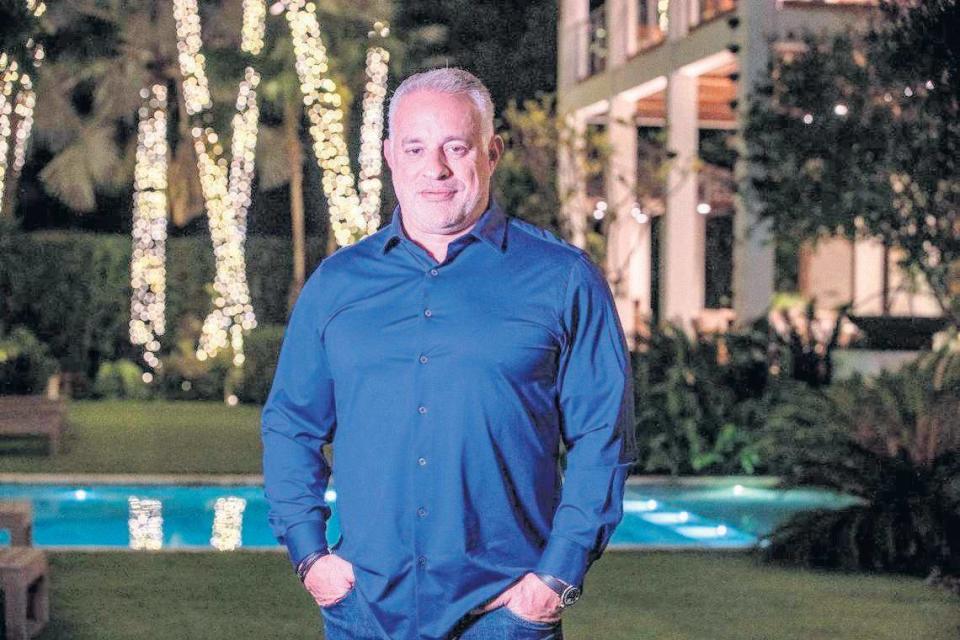

When attorney John H. Ruiz took his company public in 2022, the Miami entrepreneur promised that its software algorithms were so effective they could spot billions of dollars in improperly paid health-insurance claims that would eventually yield significant profits for investors.

Now, those problem-solving algorithms — the core of his Coral Gables-based company, LifeWallet — are being investigated by federal authorities, according to the firm’s recent filings with the U.S. Securities and Exchange Commission.

LifeWallet, in an annual report filed in April, revealed that federal civil and criminal subpoenas were seeking corporate documents about the company’s data analytics as well as its stock price decline, marketing materials and agreements offered to potential investors.

Those revelations — which hint at federal investigators’ focus on whether LifeWallet may have misled investors — come as the company announced 2023 revenue of little more than $7.7 million, far less than what the company projected before it went public in 2022. LifeWallet also reported that its net loss last year had ballooned to $835 million, more than double what the company reported for the previous year, and that it carries a heavy debt load that could soon grow even larger.

SEC, grand jury seeking records from Ruiz’s company

In the April 15 filing, the company said that the Securities and Exchange Commission issued subpoenas seeking information about “certain historical and projected financial results, investor agreements, and data analytic platforms and algorithms.”

The company also said a grand jury in the Southern District of Florida had subpoenaed documents related to “the Company’s proprietary algorithms and other software” as well as “the drop in the price of the Company’s common stock.” The company went public in May 2022 through a merger with a special purpose acquisition company, or SPAC. The company’s stock price lost more than half its value the day it began trading and it’s currently trading for less than $1.

The federal investigations into the company aren’t new, and were first reported by the Miami Herald last year, but the SEC filings in February and April provide more information about the subpoenas and what U.S. authorities are zeroing in on at LifeWallet.

“Any potential misrepresentations regarding a public company’s business capabilities and operations have been historically ripe areas for the Justice Department and SEC to investigate,” said Richard Hong, a veteran litigator who worked more than 25 years for the U.S. Attorney’s Office in Miami and the Justice Department in Washington, D.C., as well as the SEC.

All of these factors, ranging from questions about LifeWallet’s algorithms to carrying heavy debts, point to a company that could be headed toward bankruptcy, said Jay Ritter, a business professor at the University of Florida.

“The company clearly doesn’t have a business model that looks like profitability is around the corner,” Ritter told the Miami Herald.

Ruiz, who is perhaps best known in South Florida as a major University of Miami booster whose companies have backed various UM athletes with hundreds of thousands of dollars in name, image and likeness sponsorships, did not respond to multiple requests for comment from the Herald. Nor did LifeWallet’s corporate lawyer, Gonzalo Dorta, or the company’s public relations firm respond to the Herald’s queries.

In its latest annual report filing with the SEC, LifeWallet said: “To the best of the Company’s knowledge, the Department of Justice has not issued any target letters to anyone associated with the Company as a result of this investigation.” That means that federal authorities have not notified Ruiz that he is a “putative defendant” in the probe, though Hong and other former federal prosecutors have told the Herald that such letters are typically sent at the end of an investigation, if at all.

“The Company has cooperated, and will continue to cooperate, fully with these inquiries,” LifeWallet said in the mid-April SEC filing.

Ruiz has long maintained that the company’s algorithms and data analysis are what sets LifeWallet apart.

When the merger was announced in July 2021, Ruiz told investors that the company relied on “more than 1,400 algorithms which help identify billions in recoverable claims.”

The company identifies instances in which the wrong insurer paid a claim and then attempts to recover money from the party that should have paid – such as when a health insurance company pays medical bills after a car accident that should have been paid by a car insurer. Ruiz’s company focuses on recovering insurance payments incorrectly made by Medicare-affiliated carriers, with the goal of splitting the potentially vast proceeds between the company and the claimant.

Ruiz said to investors in 2021 that the company’s “data-driven” approach would “disrupt the antiquated healthcare reimbursement system” and would eventually incorporate artificial intelligence, or AI.

When the company went public in 2022, it was valued at more than $32 billion.

So far, the company’s efforts have not resulted in significant revenue. While the company said it has been assigned the right to pursue claims valued at $1.5 trillion in their billed amount, it has taken in just over $12 million in claims recovery income in 2022 and 2023 combined. That’s well short of the company’s initial lofty projections that it would take in more than $990 million in gross revenue in 2022 and more than $3 billion in gross revenue in 2023.

The company announced in early March that it had reached a settlement with 28 affiliated property and casualty insurers, but it didn’t disclose how much LifeWallet took in from the agreement.

Forced to take on more debt

In the February filing, LifeWallet first shared greater detail about the dual investigations after SEC regulators had told the company in December to disclose the probe by the agency more prominently in its registration statement.

As the company has struggled to increase revenue, it has been forced to take on additional debt and strike deals with existing lenders, pushing back the due dates on existing loans. The company acknowledged in its annual 2023 filing in April that its loans have high interest rates that will “continue to increase over time by a significant amount” if the company can’t boost revenue soon and begin paying down what it owes.

That debt could also drive down the price of the company’s stock, since LifeWallet said it could issue new shares to satisfy its obligations to one of its lenders, diluting existing shares.

“I think that should definitely be a concern for investors here,” said Ritter, the business professor at the University of Florida.

Last August, the health-insurance claims company led by Ruiz acknowledged for the first time in SEC filings that LifeWallet was under federal civil and criminal investigations. Months earlier, the company had admitted to accounting issues that rendered two of its financial filings for 2022 unreliable.

Subpoenas for corporate records

LifeWallet, which went public in May 2022, disclosed that the SEC initiated an investigation into the company three months later. The company also revealed that it received three SEC subpoenas in 2023 for a variety of corporate records.

The company also said it received a subpoena in March 2023 from the U.S. Attorney’s Office for similar records in connection with a grand jury investigation in the Southern District of Florida.

But no details were revealed at that time about specific records – such as LifeWallet’s algorithms – that federal authorities were seeking from the company and its executives, including Ruiz.

Hong, the former federal prosecutor and SEC lawyer, said that it comes as no surprise that authorities are focusing on LifeWallet’s software because its data analysis is touted as the force behind its business of recovering health insurance claims.

“These days, in the age of AI, a company’s alleged secret sauce is frequently claimed as some proprietary algorithm or AI-driven technology,” said Hong, a partner with the Morrison Cohen law firm in New York. “So, both the Justice Department and SEC are looking into such claims more intensely these days.”