Are California drivers stuck with high gas prices for good?

A year after California Gov. Gavin Newsom signed a bill aimed at punishing oil companies for allegedly gouging drivers with high gas prices, no clear evidence has emerged that gouging is actually taking place.

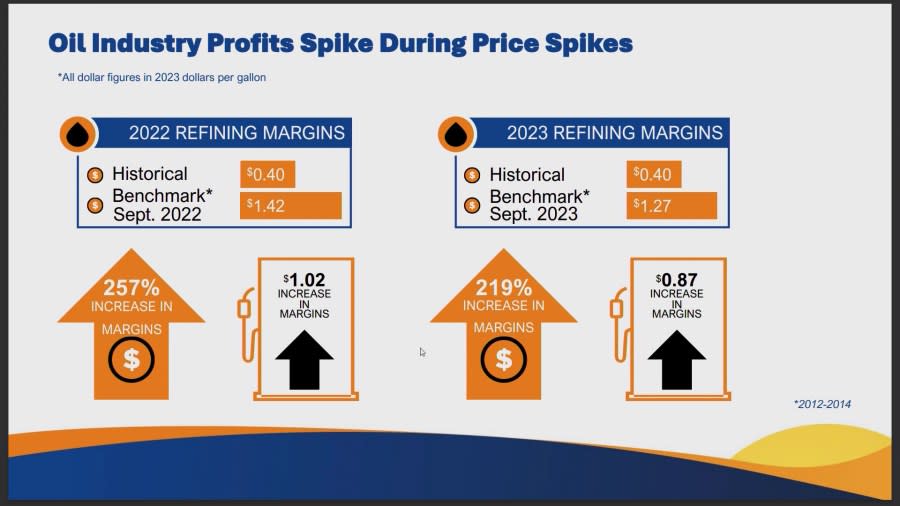

That acknowledgment came from the state’s Energy Commission during a Senate oversight hearing in Sacramento on Tuesday. Oil refiners, however, were not given a pass, as data showed their profit margins soared by more than 200% when prices at the pump spiked in 2022 and 2023.

“None of the industry [representatives] in our good faith discussions dispute that during these times, their profits go up a lot,” California Energy Commission Vice Chair Siva Gunda told the panel. “So, who’s to decide how high can you go during those times? That’s what we’re trying to think through.”

Newsom relaxes refinery rules as California gas prices soar

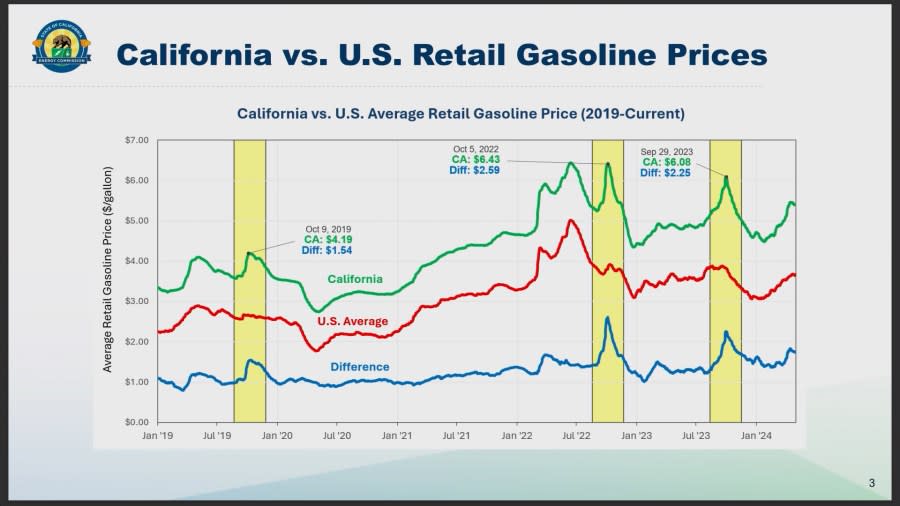

Senate Bill x1-2 was drafted during a special session convened after gas prices reached an average of $6.39 per gallon in California in October 2022, $2.58 above the national mark. Outrage among drivers and lawmakers reached a boiling point, and democrats, led by Newsom, hoped the threat of a windfall profits cap would drive prices lower.

The average price for a gallon of regular unleaded in California on Thursday was $5.31, $1.67 higher than the national average, according to AAA.

“Drivers correctly wonder why gas prices tend to go up quickly but come down slowly,” says KTLA 5 News consumer reporter David Lazarus. “That would seem to be evidence of price gouging. But energy experts say this is how things have worked for decades – that it’s a quirk of the market – and that makes it difficult to prove malicious intent on the part of oil companies.”

At Tuesday’s hearing, members of the commission and representatives from the petroleum industry agreed that gas prices in California have risen disproportionately due to a complex web of factors. Most notable, they say, is the shuttering of refineries in the state over the past 40 years, from over two dozen to just nine today.

“In California, four companies control more than 90% of our refining capacity. That’s what economists call a highly concentrated industry,” said Tai Milder, a veteran prosecutor and antitrust expert who now runs the California Energy Commission’s oversight division.

The experts said this dearth of refining capacity, when combined with fluctuating global oil prices and refinery maintenance, creates instability.

“The market is driven by supply and demand, and California has a chronic gasoline supply issue,” Cathy Reheis-Boyd, president of the Western States Petroleum Association, told the committee in arguing against the threatened windfall tax. “California used to produce 50% of the crude oil needed to meet consumer demand. Now we only produce 25%. The rest of California’s oil and gasoline is imported from foreign countries.”

The problem, Reheis-Boyd contends, is not a lack of oil in the Golden State but rather a lack of will to address the supply issue.

Newsom signs law allowing California to penalize oil companies for ‘price gouging’

“The evidence collected by third-party experts and even the CEC has been clear that the underlying market reasons for California’s high gasoline prices and ongoing market volatility are traced to obstacles to market supply and sustained, strong demand from California citizens,” she testified.

The gradual shift to electric vehicles, Gunda warned, likely won’t bring prices down significantly in the long term.

“And as we move into more and more EV adoption, which is 25% of new sales today … we’ll have the refinery production go down, but also the competitiveness of the market will continue to decline,” Gunda said.

Assuming price gouging cannot be proven and penalized, state regulators are exploring other options to make gasoline more affordable.

Gunda said one option is a utility model where both profits and prices would be regulated. Another more extreme option would be to follow Australia’s post-COVID decision to subsidize the oil industry after a number of refineries shut down.

“So those are the things that might be on the table,” said Gunda.

For the latest news, weather, sports, and streaming video, head to KTLA.