I just paid my taxes. Biden's pandering on student loans will end up costing us all more.

My husband and I both work full time. We like our jobs, but we work hard. Our reward? Sending thousands of dollars to the federal government each year.

Much like millions of other Americans on Tax Day, we had to write a large check and send it off to the Internal Revenue Service.

It’s always painful to kiss that money goodbye. It’s even more difficult when I know just how poorly it will be spent.

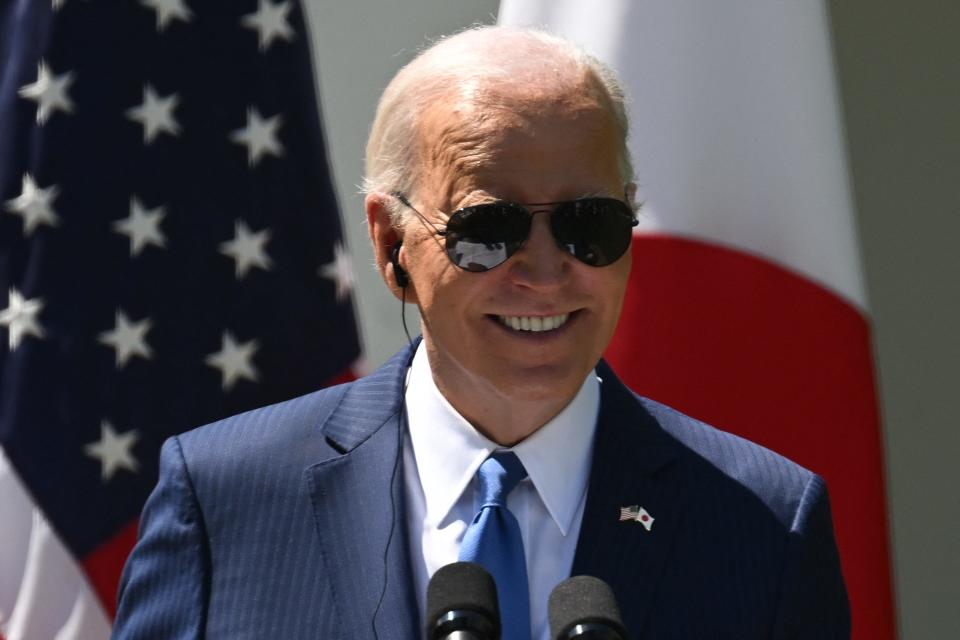

Case in point: President Joe Biden continues to doggedly pursue student loan “forgiveness” ahead of the November election.

Biden fumbles FAFSA: Biden's so worried about 'canceling' debt he's ignored families who need to pay for college

Perhaps Biden misread his job description. Instead of commander in chief, he is acting like the panderer in chief.

Essentially, he’s using our tax dollars as campaign funds.

Biden is using taxpayer dollars to get himself reelected

It seems not a week goes by when Biden isn’t announcing some plan that will magically wipe out swaths of student loans. That’s intentional, as Biden struggles with keeping young voters interested in his candidacy.

He’s betting that erasing all this debt will buy him more votes come November.

That became more urgent after the U.S. Supreme Court last summer overturned his initial unilateral attempt to cancel more than $400 billion in debt.

Biden uses big government to buy votes. Meanwhile, Argentina's Milei schools him on capitalism.

Rather than learn anything from this setback, Biden immediately set off to find other ways he could force taxpayers to cover the cost of paying off other people's student loans – never mind that the president's new efforts are almost surely just as unconstitutional as his first try.

As a taxpayer (and someone who has paid off my college loans), I find Biden’s costly new entitlement program to be irksome. After all, the debt doesn’t simply go away – it is loaded onto taxpayers' backs and added to our $34 trillion and counting national debt.

Last week, Biden waved his magic wand again, announcing his latest round of lucky borrowers. More than 270,000 people in Biden’s revamped income-driven repayment plans will see $7.4 billion in debt canceled.

That brings Biden's total debt transference from student borrowers to taxpayers at large to $153 billion. About 4.3 million borrowers have benefited from Biden’s generosity with taxpayers' money.

And Biden has plans to expand who’s eligible in the coming months through a different program.

In addition to adding to the national debt and our tax burden as a country, Biden’s actions are inflationary. Out-of-control government spending is one reason why inflation has remained so entrenched during his administration.

Forgive loans so people can 'go back to school'?

My guess is most people who get their student debt zeroed out by Biden will go on some sort of spending spree. Progressive superstar Alexandria Ocasio-Cortez recently admitted as much while on the "Late Show with Stephen Colbert."

The U.S. representative from New York said Biden’s latest student cancellation proposal means “hope to buy a house, or have a kid, or travel abroad or maybe even go back to school.”

America's deep divide: Are we hurtling toward a new 'Civil War'? Hollywood plays to fears of Trump-Biden rematch.

That tracks with what a 2022 poll found after Biden’s initial debt plan rolled out. According to Intelligent.com, 73% of anticipated recipients said they planned to spend the forgiven amount on nonessential things like travel, eating out and new gadgets.

These are all things most Americans want. But why should taxpayers who didn’t go to college or who have paid off their debt subsidize the spending decisions of strangers?

And let’s not forget the most egregious part of Biden’s tax-dollar giveaway. Biden loves to tout how this election is all about democracy. In continuing with such sweeping executive action, however, he’s proving that he is a threat to our system of checks and balances.

Opinion alerts: Get columns from your favorite columnists + expert analysis on top issues, delivered straight to your device through the USA TODAY app. Don't have the app? Download it for free from your app store.

Biden has failed to go through Congress, which should sign off on such a costly expenditure. And he has ignored a pointed rebuke from the Supreme Court.

"The Biden administration is once again looking to have a huge, unilateral – and hence unconstitutional – student debt cancellation," Neal McCluskey, education policy expert at the Cato Institute, observed on X.

I don't appreciate my hard-earned dollars being used by Biden to buy favor among voters. And I resent that he's doing it in such a blatantly undemocratic manner.

Ingrid Jacques is a columnist at USA TODAY. Contact her at ijacques@usatoday.com or on X, formerly Twitter: @Ingrid_Jacques.

You can read diverse opinions from our Board of Contributors and other writers on the Opinion front page, on Twitter @usatodayopinion and in our daily Opinion newsletter.

This article originally appeared on USA TODAY: Biden's student loan forgiveness scheme will push inflation up again